salt tax new york state

New Yorks pass-through entity tax will allow certain partnerships and New York S corporations an annual election to pay income tax on behalf of its owners. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on.

. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017. State and Local Tax SALT tax deduction cap explained. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. The cap affects high tax states like New York. Learn about New Yorks pass-through entity tax to help you work around it.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisionsIt is anticipated. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. The IRS responded in 2019 to these potential workarounds by issuing regulations to close the door on the state workarounds.

New York made up the next highest percentage of national SALT. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as. On April 6 2021 New York Gov.

The Pass-Through Entity tax allows an eligible entity to pay New York State tax. According to WalletHub when you measure taxes on individual. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap.

The election must be made by October 15 for tax year 2021. Yet while the newly adopted budget encourages high-income taxpayers to take advantage of these provisions they ought to come with a warning. A major part of the budget legislation is a new pass-through entity tax that is.

New York New Jersey Illinois Texas and. Scott is a New York attorney with extensive. 52 rows The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

One of these provisions limits the Federal itemized deductions for State and Local Tax SALT to 10000. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. What the New York State Pass-Through Entity Tax Does.

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades.

Friday December 18 2020. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. New York State and other states began to work on a solution to alleviate the effects of the limitation.

In direct response to the 10000 cap on the state and local tax deduction added by the Tax Cuts and Jobs Act in 2017 many. The assembly and senate have passed the budget legislation and the legislation has been delivered to the governor for signature. This provision is not available for publicly traded partnerships.

California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions. Starting with the 2018 tax year the maximum SALT deduction available was 10000. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion.

The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget. The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of.

The 10000 cap on state and local tax deductions for now may be here to stay however. Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

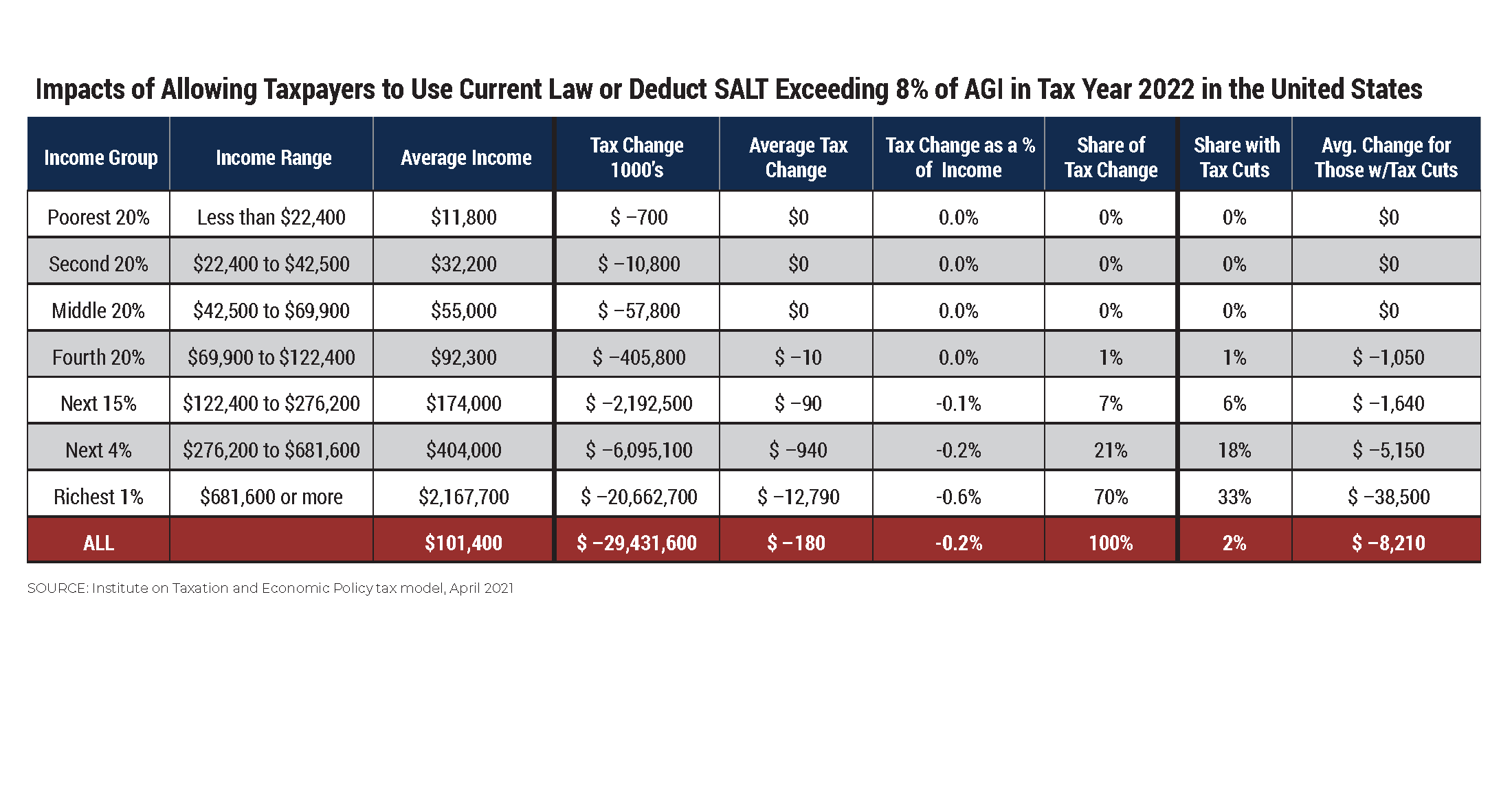

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation